As part of its efforts to ease the tax burden on individuals, the government has proposed to re-instate the 37% tax rate for middle income earners that would otherwise be abolished under the legislated “Stage 3” tax cuts.

Meanwhile low income earners could be seeing their tax rates reduced from 19% to 16% from 1 July 2024. The Medicare levy low-income thresholds for 2023−24 will also be increased.

Domain Registration and Securing Your Online Presence

| Current income threshold | Current tax rate (%) |

|---|---|

| 0 – 18,200 | 0 |

| 18,201 – 45,000 | 19 |

| 45,001 – 120,000 | 32.5 |

| 120,000 – 180,000 | 37 |

| >180,001 | 45 |

New Stage 3 tax cuts proposed

From 1 July 2024, the government proposes to:

- reduce the 19% tax rate to 16% for incomes between $18,200 and $45,000

- reduce the 32.5% tax rate to 30% for incomes between $45,000 to a new $135,000 threshold

- increase the threshold at which the 37% tax rate applies from $120,000 to $135,000, and

- increase the threshold at which the 45% tax rate applies from $180,000 to $190,000.

The tax thresholds and rates proposed to apply from 2024—25 are as follows:

| Proposed income threshold: 2024-25 onwards ($) | Proposed tax rate: 2024-25 onwards (%) |

|---|---|

| 0 – 18,200 | 0 |

| 18,201 – 45,000 | 16 |

| 45,001 – 135,000 | 30 |

| 135,001 – 190,000 | 37 |

| >190,001 | 45 |

The proposed elimination of legislated Stage 3 tax cuts

The government will not proceed with the Stage 3 tax cuts (enacted by Act No 47 of 2018 and Act No 52 of 2019) that were due to take effect from 1 July 2024. The legislated Stage 3 tax cuts were as follows:

- a 30% tax rate was to apply to an individual’s ordinary taxable income between $45,001 and $200,000 (rather than $87,000, $90,000 or $120,000)

- a 45% was to apply to an individual’s ordinary taxable income exceeding $200,000 (rather than $180,000), and

- the 37% rate of income tax was to be abolished.

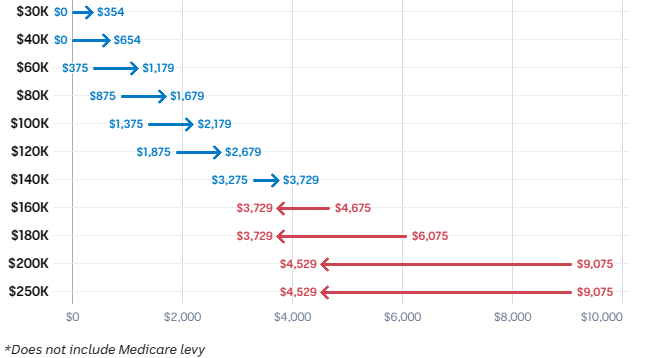

The proposed changes will reduce benefits for higher-income earners in order to fund returns for lower-income earners.

Medicare levy threshold to be increased

In addition, the Medicare levy low-income thresholds for 2023−24 will be increased.

For the 2022−23 income year, the threshold amount for individuals other than certain pensioners is $24,276. Where the taxable income for 2022−23 is more than $24,276 but does not exceed $30,345, the levy is shaded in at the rate of 10% of the excess over $24,276.

Source: Prime Minister,Treasurer and Minister for Finance, Tax cuts to help Australians with the cost of living,[joint media release], 25 January 2024, accessed 25 January 2024.

If this email raises any concerns for you, please get in touch with your Advisor.