Now that the 2023/24 Financial Year has begun, there are a number of key dates business owners need to be aware of. We have compiled a list of the most common dates however, this list is not exhaustive and there may be other deadlines you need to meet. For more specific advice, please get in touch with your advisor.

Payment Summaries & Single Touch Payroll Finalisation

You are required to provide a payment summary to all employees by 14th July each year, regardless of the amount withheld. However, payment summaries are not necessary for information reported and finalised using Single Touch Payroll (STP). Instead, you must make a finalisation declaration by 14th July annually.

You are required to provide a payment summary to all employees by 14th July each year, regardless of the amount withheld. However, payment summaries are not necessary for information reported and finalised using Single Touch Payroll (STP). Instead, you must make a finalisation declaration by 14th July annually.

Compulsory Superannuation Payments

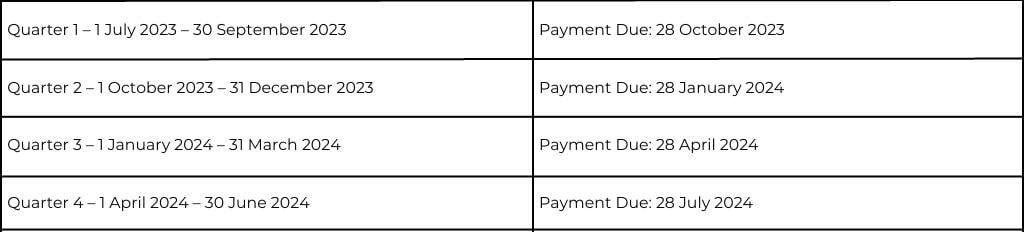

To avoid the super guarantee charge, you need to pay superannuation for eligible employees starting from their first day of work. Payment deadlines occur quarterly.

The due dates are the day that the funds need to be in the superannuation account. You should allow a few days beforehand to ensure payment arrives into the account in time.

You may pay super more frequently than quarterly. However, make sure that you pay the total superannuation guarantee (SG) contribution for the quarter before the deadline.

It is important to note that the Government announced in their most recent Budget that as of the 2026 Financial Year, superannuation will need to be paid at the same time as their salary and wages.

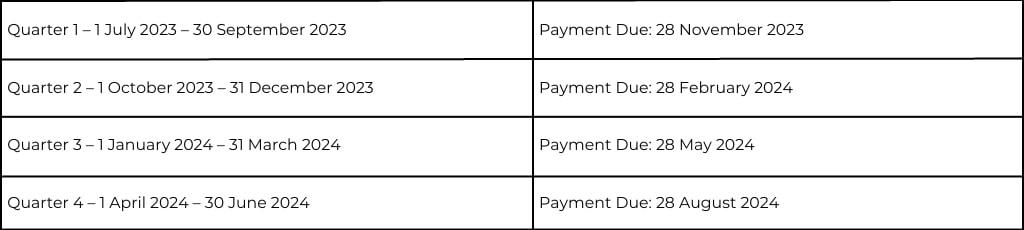

Superannuation Guarantee Charge Statement

Employers who do not pay the minimum super contributions by the due date must pay the super guarantee charge (SGC) and lodge a SGC statement by the dates outlined below:

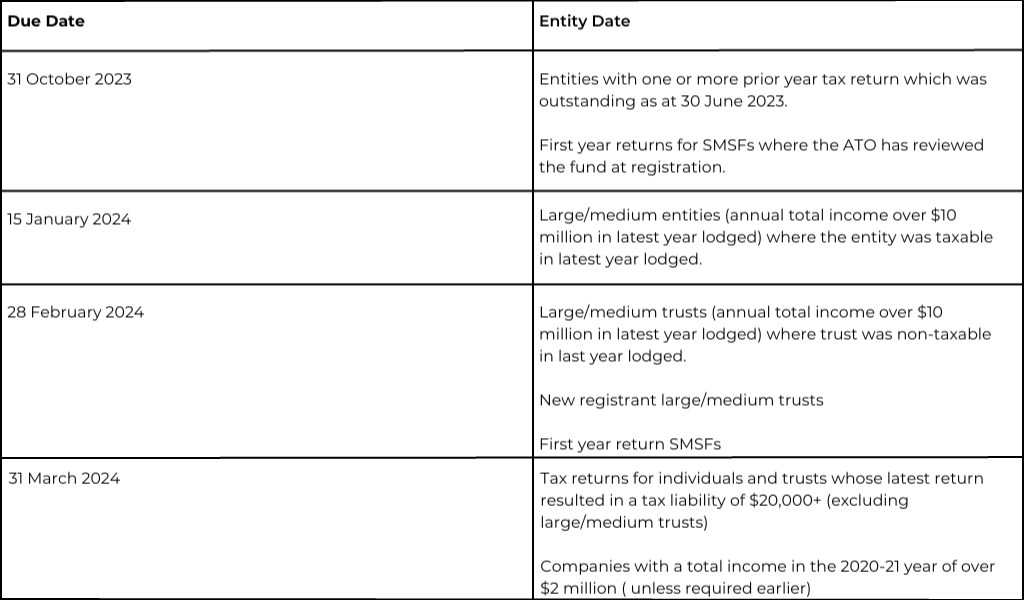

Tax Lodgement Due Dates

Income tax for most entities is due to be lodged by 15 May 2024. Some entities may require an earlier lodgement. The dates are listed below.

Business Activity Statements (BAS) / Instalment Activity Statements (IAS)

Monthly Lodgements:

If your GST turnover is $20 million or more, you must report and pay GST monthly and lodge your activity statements online.

The monthly due date to lodge and pay your BAS is the 21st day of the following month.

Quarterly Lodgements:

The due date to lodge and pay your quarterly BAS is the 28th day of the month following the end of the quarter unless you lodge through a tax agent.