There have been several developments recently which are relevant to Not-For-Profit organisations and charities, which have been outlined below.

Discontinuation of project: Definition of Not-For-Profit entity

In June 2019, the Australian Accounting Standards Board (AASB) issued Exposure Draft ED 291 Not-For-Profit Entity Definition and Guidance. This proposed a replacement of the current “Not-For-Profit entity” definition in Australian Accounting Standards.

At its April 2021 meeting, the AASB decided to discontinue this project, retaining the current ‘not-for-profit entity’ definition in Australian Accounting Standards. The definition of a Not-For-Profit entity remains defined as “an entity whose principal objective is not the generation of profit”.

The AASB recognised that while the majority of the respondents to the draft showed support for the proposals, there were reservations about the clarity of the implementation guidance, the level of judgement required and the expected transition effort and cost for some entities. Acknowledging these concerns, AASB concluded that the potential benefits of the proposals are unlikely to justify the cost of their implementation.

Tier 3 Reporting Requirements

The AABS is currently in the process of deciding whether the primary objective of Tier 3 reporting requirements should be to simplify accounting requirements or to facilitate comparability between Tier 3 NFP private sector entities.

The AASB has proposed developing Tier 3 reporting requirements as a single stand-alone pronouncement, tailored to NFP private sector entities with revenue between $0.5m- $3m.

Tier 3 accounting requirements are subject to the following:

- Tier 3 financial statements would be General purpose financial statements. They are being developed as a proportionate response to the costs incurred whilst meeting the needs of the users of the financial statements.

- The aim of developing accounting requirements is to maximise leveraging information that management uses to make decisions about the entity’s operations.

Accounting for controlled entities

The AABS also made decisions around the accounting for controlled entities for Tier 3 NFP entities. The key decisions are:

- Not developing any specific guidance or criteria on identifying controlled entities and make any amendments to the “control” principle set out in AASB 10 Consolidated Financial Statements for Tier 3 reporting requirements as the forthcoming post implementation review of Appendix E of AASB 10 is expected to address the application of this principle for NFP entities

- Entities preparing Tier 3 General purpose financial statements are allowed the choice of presenting either:

- Consolidated financial statements, consolidating all of its controlled entities, as specified by AASB 10, or

- Separate financial statements as its only financial statements.

Where an entity presents separate financial statements, it will also need to disclose its ‘significant relationships’, provide users of the financial statements with information on the other entities that could significantly affect the entity’s future financial position or performance.

Post-implementation review of AASB 1058 Income of Not-For-Profit Entities

AABS has added a narrow-scope project to its work program, considering implementation issues raised by NFP sector stakeholders during targeted outreach regarding AASB 15 Revenue from Contracts with Customers and AASB 1058. The project is expected to commence this year.

New ACNC thresholds and additional financial reporting obligations

ACNC thresholds

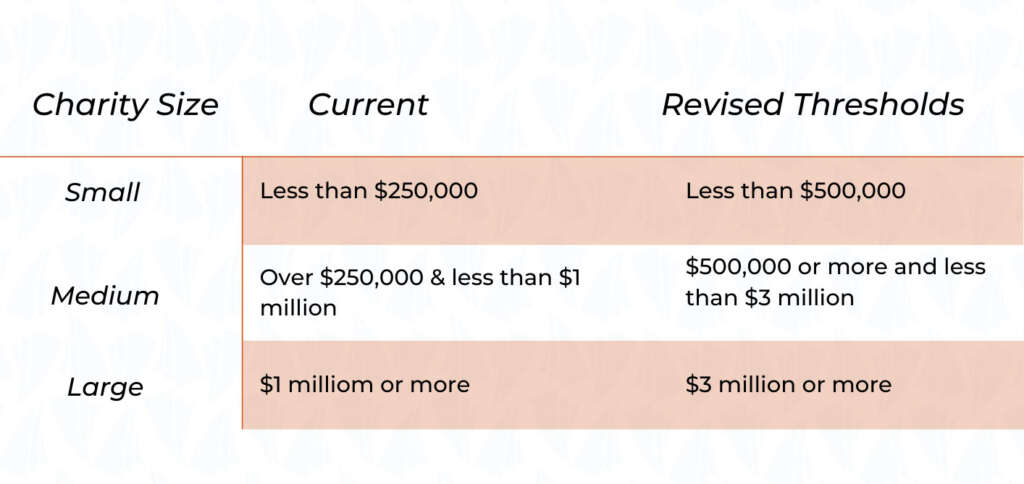

On 30 June 2021, the Council on Federal Financial Relations has announced the revised financial reporting thresholds for charities registered with the ACNC, effective for the 2021-22 financial years onwards.

Key management personnel and related party transactions disclosures

In addition to the change in thresholds above, further key financial reporting changes relate to amendments to disclosure requirements for ACNC registered entities.

These new disclosure requirements include:

- From the 2021-2022 financial year, large registered entities are required to disclose remuneration paid to responsible persons and senior executives on an aggregated basis. This disclosure is only required for entities with two or more key management personnel to accommodate privacy concerns.

- From the 2022-2023 financial year, registered entities are required to disclose related party transactions. This is for the purpose of increased transparency of transactions with related people or organisations that pose a higher risk of conflicts of interest.

If you have questions regarding the above information, do not hesitate to contact our Audit & Assurance Team audit@armada.com.au