COMPREHENSIVE CASH FLOW FORECASTING

COMPREHENSIVE CASH FLOW FORECASTING

Understanding the importance

It is common for a business to be making profits on a monthly basis yet have no money in the bank. Cash flow forecasting helps you to visualise where your money is coming from and going to, and allows you to plan more effectively and make informed decisions.

WHAT IS CASH FLOW FORECASTING?

Managing business finances

Forecasting your cash flow is a process of determining the amount of cash that will be generated by a business over a specific period of time.

By implementing this service, you are utilising a financial forecasting tool that forecasts the cash available from your business activities. This is based on expected income and expenses, cap ex, loan payments, and takes into account all other cash transactions for your business, including drawings, employee and tax obligations.

WHAT IS CASH FLOW FORECASTING?

Managing business finances

Forecasting your cash flow is a process of determining the amount of cash that will be generated by a business over a specific period of time.

By implementing this service, you are utilising a financial forecasting tool that forecasts the cash available from your business activities. This is based on expected income and expenses, cap ex, loan payments, and takes into account all other cash transactions for your business, including drawings, employee and tax obligations.

WHY DO YOU NEED CASH FLOW FORECASTING?

Cash flow forecasting will help your business manage its finances by identifying potential cash shortfalls, so you can act well in advance of any time you may exceed your overdraft limits. This is essential if you are looking to create a successful and sustainable business.

WHAT ARE THE BENEFITS OF CASH FLOW FORECASTING?

- Identify Cash Shortages: Proactively detect potential cash shortages.

- Make Informed Financial Decisions: Use your cash flow analysis to guide your investment strategies, such as cap ex decisions.

- Efficient Working Capital Management: Optimise your cash resources through effective cash flow management.

- Increased Financial Stability: Strengthen your financial position and reduce risks using the cash flow projections.

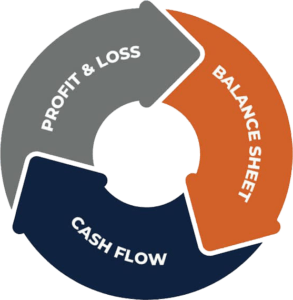

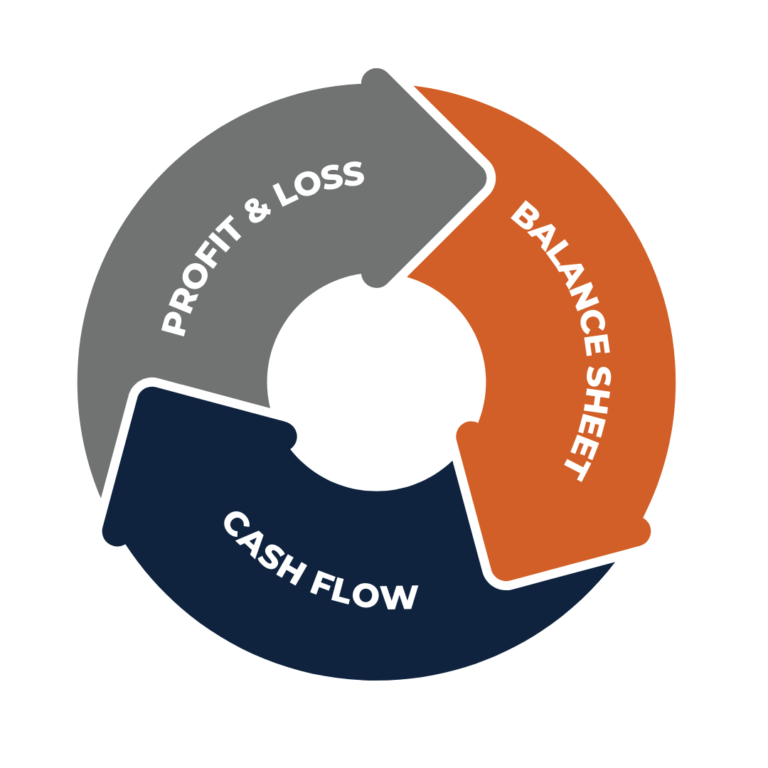

WHAT IS THREE-WAY CASH FLOW FORECASTING?

A 3-Way cash flow forecast combines your profit and loss budget, ongoing asset and liability position to predict the cash coming in and going out of your business. It is common for banks and other lenders to request these before granting finance. 3-way forecasts are a fantastic tool to show you where your cash goes each month.

WHAT IS THREE-WAY CASH FLOW FORECASTING?

A 3-Way cash flow forecast combines your profit and loss budget, ongoing asset and liability position to predict the cash coming in and going out of your business. It is common for banks and other lenders to request these before granting finance. 3-way forecasts are a fantastic tool to show you where your cash goes each month.

KEY COMPONENTS OF THE THREE-WAY CASH FLOW FORECAST

Profit and Loss Budget

A profit and loss budget details a business’s expected revenues, expenses, and from those the budgeted profits.

While a profit & loss budget may identify areas for improvement, it does not indicate the impact of the business performance on cash. Combining it with a cash flow forecast provides a comprehensive view of your business cash flows.

Asset and Liability Position

The asset and liability position of a business is referred to as the balance sheet. A balance sheet projection estimates future assets and liabilities based on expected capital expenditures, equity withdrawals, GST/tax payments, and financing arrangements.

When paired with the profit and loss budget, it provides a clear financial position for your business and can be used to project cash flows.

Cash Flow Forecast

A cash flow forecast is essential for monitoring business cash movements, showing the cash inflows and outflows from your business operations. It helps you identify months where cash shortages might occur, enabling you to implement effective cash management strategies.

Profit and Loss Budget

A profit and loss budget details a business’s expected revenues, expenses, and from those the budgeted profits.

While a profit & loss budget may identify areas for improvement, it does not indicate the impact of the business performance on cash. Combining it with a cash flow forecast provides a comprehensive view of your business cash flows.

Asset and Liability Position

The asset and liability position of a business is referred to as the balance sheet. A balance sheet projection estimates future assets and liabilities based on expected capital expenditures, equity withdrawals, GST/tax payments, and financing arrangements.

When paired with the profit and loss budget, it provides a clear financial position for your business and can be used to project cash flows.

Cash Flow Forecast

A cash flow forecast is essential for monitoring business cash movements, showing the cash inflows and outflows from your business operations. It helps you identify months where cash shortages might occur, enabling you to implement effective cash management strategies.

A 3-Way forecast should cover a 12-month period and should be integral to your business planning. This approach allows you to develop a solid understanding of cash movement and compare actual results to projections. For more information and tailored cash flow forecasting advisory services, contact one of our specialists.

COMMONLY ASKED QUESTIONS

Cash flow forecasting focuses specifically on cash movements over a given period, while profit and loss statements provide an overview of revenues, expenses and profits. The cash flow forecast helps to manage liquidity, whereas profit and loss statements assess overall profitability.

Cash flow control refers to the strategies and practices implemented to manage cash inflows and outflows effectively, before any cash flow crisis. It relies on forecasting to anticipate cash flow needs, allowing businesses to make informed decisions and avoid potential liquidity issues.

Seasonal fluctuations can significantly impact cash flow, particularly for businesses with variable sales throughout the year. Analysing historical data to identify trends and incorporating this data into your forecasts is essential for effective planning, particularly for those leaner months.

If your cash flow forecast indicates a potential shortfall, consider implementing cash management strategies, such as reducing discretionary expenses, negotiating payment terms with suppliers, increasing sales efforts, or seeking short-term financing to bridge the gap.

Cash flow forecasting focuses specifically on cash movements over a given period, while profit and loss statements provide an overview of revenues, expenses and profits. The cash flow forecast helps to manage liquidity, whereas profit and loss statements assess overall profitability.

Cash flow control refers to the strategies and practices implemented to manage cash inflows and outflows effectively, before any cash flow crisis. It relies on forecasting to anticipate cash flow needs, allowing businesses to make informed decisions and avoid potential liquidity issues.

Seasonal fluctuations can significantly impact cash flow, particularly for businesses with variable sales throughout the year. Analysing historical data to identify trends and incorporating this data into your forecasts is essential for effective planning, particularly for those leaner months.

If your cash flow forecast indicates a potential shortfall, consider implementing cash management strategies, such as reducing discretionary expenses, negotiating payment terms with suppliers, increasing sales efforts, or seeking short-term financing to bridge the gap.